What Is Physicians Mutual Dental Insurance and How Does It Work?

- Foreword: Understanding Dental Insurance in the Real World

- Part One: What Is Physicians Mutual Dental Insurance?

- Part Two: What Do the Plans Actually Cover?

- Part Three: Costs, Premiums, and What You Really Pay

- Part Four: How the Claims and Reimbursement Process Works

- Part Five: Is It Worth It? Real-Life Use Cases

- Part Six: Common Complaints and Misunderstandings

- Part Seven: Alternatives and How It Compares

- Part Eight: Frequently Asked Questions

- Closing Thoughts

Foreword: Understanding Dental Insurance in the Real World

There’s a strange truth about dental care in the U.S. — we know it’s important, but it rarely gets the same attention as medical care. Maybe that’s because it feels separate. Maybe it’s because people assume a dental plan will act like medical insurance, and when it doesn’t, they’re caught off guard. Either way, most people don’t look into dental coverage until they’re facing something they can’t afford out of pocket. A crown, a root canal, new dentures — or sometimes just the slow realization that skipping cleanings is starting to catch up with them.

That’s usually where Physicians Mutual comes in. You’ve probably seen their brochures or commercials — they promise “no annual maximums,” freedom to see any dentist, and coverage that gets better over time. And depending on who you are and what you need, those promises might actually hold up. But as with any insurance product, the details matter. What they cover. What they don’t. How they pay. And whether it’s actually a good fit for you — not just in theory, but in real, day-to-day usage.

This isn’t about pushing a plan or steering you toward a yes or a no. It’s about giving you the clearest possible picture of how Physicians Mutual dental insurance works — not in sales language, but in plain terms. We’ll talk through the benefits, the costs, the limitations, and the stuff that doesn’t always make it into the brochure. We’ll look at real examples of what happens when you need work done, how the claims process goes, and why some people stick with it while others walk away.

Because dental coverage is one of those things that only feels confusing until someone explains it in human language. Once you understand how the moving parts fit together — premiums, reimbursements, waiting periods, caps — you can make a clear-headed decision without second-guessing yourself every time a tooth starts to hurt.

So let’s break it down, piece by piece. Starting with the basics: what exactly is Physicians Mutual Dental Insurance, and why do so many people look into it in the first place?

Part One: What Is Physicians Mutual Dental Insurance?

Physicians Mutual is a Nebraska-based insurance company that’s been around since the early 1900s. It started with health and life insurance, but over the past few decades, it’s become best known for one thing: standalone dental coverage, especially among retirees and people who don’t have employer-sponsored plans. If you’ve seen their mailers, heard their ads on TV, or gotten a brochure from a friend, it’s likely been focused on that.

But unlike group dental plans from employers or union benefits, this is a private, individual policy. You apply for it on your own, pay monthly premiums out of pocket, and keep it as long as you choose — or until the pricing doesn’t make sense for your situation anymore. It’s not tied to Medicare, although it’s often marketed heavily to seniors, since Original Medicare doesn’t include dental coverage at all.

There’s no PPO network or HMO restrictions. Physicians Mutual pitches itself as a go-anywhere plan — you can see any dentist you like, and the insurance reimburses you (or sometimes the dentist) based on a fixed schedule of benefits. That might sound like a small thing, but for people in areas with limited dental providers or strong preferences for a particular office, freedom of provider can make or break the value of a policy.

Still, this isn’t “dental insurance” in the same way most people think of health insurance. There’s no deductible. There’s no out-of-pocket maximum. And unlike many employer-sponsored plans that offer 80% coverage after a small co-pay, Physicians Mutual uses a flat benefit schedule — which means you get a specific dollar amount for each procedure, no matter what your dentist actually charges. If your dentist’s rates are higher than what the plan covers, you make up the difference.

That’s not necessarily a bad thing — especially if you understand it going in. But it does mean you have to run the numbers yourself to figure out if the coverage makes financial sense for your needs.

Most people who sign up are looking for one of three things: help with routine preventive care (like cleanings and exams), support for more serious work (like crowns or dentures), or a way to avoid being blindsided by a $1,500 bill for something unexpected. Physicians Mutual tries to offer some degree of support across all three — though how well it performs in each category depends a lot on which plan you pick, how long you’ve had it, and how often you actually use it.

So yes, it’s dental insurance — but not the kind you might be used to from a job or a union. It’s standalone, individually priced, and benefit-based, designed for people who want predictability, not full protection. And the key to making it work is knowing exactly what it does and doesn’t promise.

Part Two: What Do the Plans Actually Cover?

Here’s where things start to get specific. When people hear the word “coverage,” they often picture 100% protection — like medical insurance that kicks in after a deductible or caps your out-of-pocket spending. But dental insurance rarely works that way, and Physicians Mutual is no exception. It helps — but it doesn’t shield you. What it offers instead is a slow-building structure of benefits that cover part of your costs, especially over time.

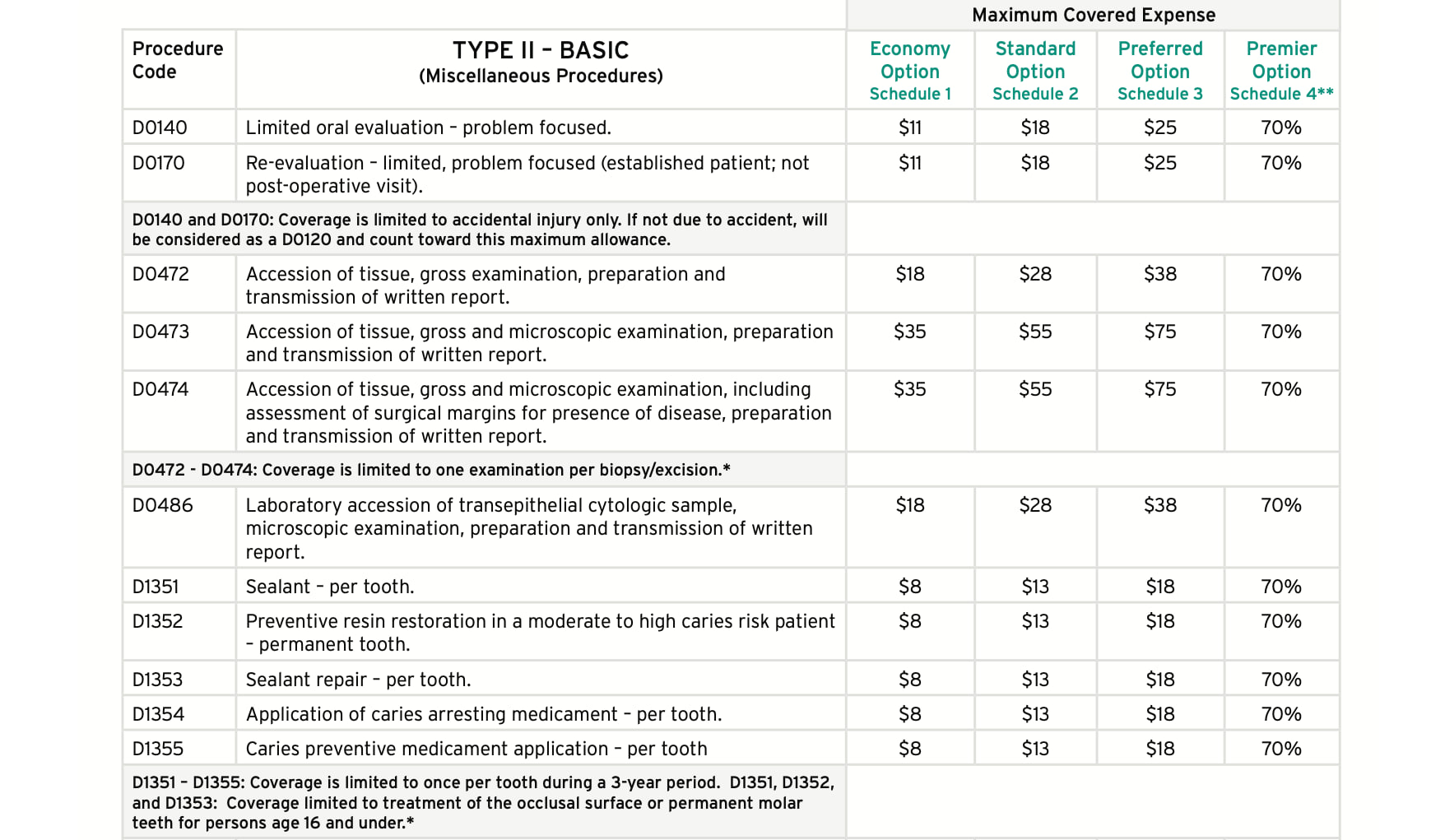

Most of Physicians Mutual’s dental plans are built around three service categories: preventive, basic, and major. Preventive includes cleanings, exams, and X-rays — the stuff you’re supposed to do twice a year. Basic services cover fillings and extractions. Major services include things like root canals, crowns, bridges, and dentures.

Now, all of that sounds fine on paper. But what matters is how much they’ll pay — and when. That’s where the plan structure kicks in.

Coverage tends to grow the longer you’re enrolled. In year one, the plan might cover 60% of preventive services, 30% of basic, and 10% of major. By year three, those numbers rise — preventive hits 100%, basic might reach 60%, and major services get closer to 50%. That’s the idea: you get more back the longer you stay in, and they get time to spread out risk across a larger pool of members.

But there’s a catch — reimbursement isn’t based on your dentist’s bill. It’s based on a benefit schedule that assigns specific dollar amounts to each procedure. So, say you need a crown. Your dentist might charge $1,400. Physicians Mutual might cover $300 to $500, depending on your plan and how long you’ve had it. The rest? That’s on you. It’s not coinsurance in the traditional sense — it’s a fixed payout. And if your provider charges more than what’s listed on the schedule, you’re responsible for the gap.

The plan types also differ. The company typically offers a Preferred, Standard, and Economy option. Preferred has the highest premiums but the best reimbursement rates. Economy is cheaper monthly, but you’ll see much smaller checks back when the work is done. They all cover roughly the same types of procedures — what changes is how much of each one gets reimbursed.

There’s also no coverage for cosmetic procedures — whitening, veneers, or anything that isn’t deemed medically necessary. Orthodontics (like braces or clear aligners) usually aren’t included either, even for kids, unless you’ve specifically purchased a policy with that add-on — which Physicians Mutual generally doesn’t offer on its standard dental plans.

And finally, there’s the matter of waiting periods. Preventive services are typically covered right away. Basic and major work may have delays — sometimes three to six months, depending on the plan. These periods are meant to prevent people from signing up only when they need expensive work, getting treatment, and canceling. It’s a standard practice in standalone dental policies — not unique to Physicians Mutual, but still important to know before you plan a procedure.

So what do these plans actually cover? The short answer: most of the services you’d expect, but not always in full — and never immediately at the maximum level. They reward patience. They offset risk. And they work best for people who plan to stick around and use them for years, not months.

Part Three: Costs, Premiums, and What You Really Pay

The price of dental insurance isn’t just about the monthly premium. It’s about what you pay before, during, and after the procedure — the full arc of cost from sign-up to treatment to reimbursement. With Physicians Mutual, understanding that arc makes the difference between a plan that feels helpful and one that feels frustrating.

Let’s start with the monthly premium. Most people pay somewhere between $30 and $50 per month, depending on their age, the state they live in, and which plan tier they choose (Economy, Standard, or Preferred). It’s not a huge amount, but over the course of a year, that’s $360 to $600 — and that’s before you’ve had anything done to your teeth.

Now say you go in for your routine cleaning and exam. With most plans, preventive care is either fully covered or reimbursed close to 100% — especially after the first year. So in that case, the plan works smoothly. You either pay nothing upfront, or you pay the dentist and then get reimbursed pretty closely to what you spent. If your provider charges $120 for a cleaning and $80 for the exam, and the plan pays back $180, you’re breaking even. But for a lot of people, the real test comes when something goes wrong — a cavity, a crown, or worse.

Take a filling, for example. If your dentist charges $250, but the plan pays a flat $70 to $100 depending on your tier, you’re left covering the rest. Same with a crown — where reimbursement might hit $300 or $400, but the total bill is closer to $1,400. That’s where the math starts to matter. Over the course of a year, your premiums might add up to $600. If you get one crown and the plan reimburses $400, you’re still out of pocket nearly a thousand dollars total — between the balance on the procedure and what you paid in premiums.

But that doesn’t mean it’s a bad deal — it just depends on your needs. If you’re someone who knows you’re going to the dentist twice a year, and you expect some dental work — maybe you have aging fillings, a history of root canals, or missing teeth — then having a predictable plan that takes the edge off the bigger bills can absolutely be worth it. Especially if you’re on a fixed income and the idea of a surprise $1,500 procedure is more stressful than a steady $40/month premium.

What the plan doesn’t do — and this is key — is cap your spending. There’s no out-of-pocket maximum. There’s also no deductible, which is helpful. But unlike many employer plans that cover a set percentage of procedures after you hit a threshold, Physicians Mutual just keeps reimbursing based on its schedule, no matter how much you’ve already paid out of pocket. And while they promote “no annual maximums,” that doesn’t mean you’ll get unlimited dental work covered — it just means there’s no ceiling on how many procedures you can claim in a year. The per-procedure caps still apply.

So what do you really pay? The monthly premiums, yes. But also: the difference between your dentist’s bill and the plan’s payout. And that difference can be wide if your provider’s rates are on the high end — which they often are, especially in urban areas or practices that don’t accept insurance directly.

It’s not necessarily a deal-breaker. For many people, just knowing something will come back helps — especially when facing major procedures. But if you’re expecting dental insurance that acts like a safety net, covering most of the cost once you’ve done your part, this plan might not feel like protection. It might feel more like a cushion — useful, but not soft enough to fall on.

Part Four: How the Claims and Reimbursement Process Works

One of the things Physicians Mutual likes to advertise is that you can “see any dentist.” And that part is true — there’s no network, no list of preferred providers, and no need to switch offices just to use your benefits. But what they don’t always make clear is how that freedom affects how claims are handled — and how much work might fall on you.

Here’s how it typically works: You go to your dentist, get the procedure done, and then either you or the dental officesends a claim to Physicians Mutual. Some dentists will file on your behalf. Others — especially those who don’t deal with private dental plans often — may ask you to pay upfront and then handle the claim yourself.

If you’re used to medical insurance where the provider handles everything, that can feel like a step back. But for standalone dental coverage like this, it’s common. The insurance company needs a copy of your itemized treatment plan or ADA claim form, sometimes along with your receipt. You can send it in by mail, fax, or through their online portal (which, to their credit, is fairly straightforward to use once you’re set up).

Once the claim is received, it’s reviewed against the benefit schedule. That’s the document that tells you exactly how much the company pays for a cleaning, a filling, a crown, or a denture. You don’t negotiate this number — it’s fixed. If the procedure is covered and you’ve satisfied any waiting period or policy conditions, you’ll receive a reimbursement check for that amount. That’s true even if you haven’t paid your dentist yet — although most people do, since dentists often require payment at the time of service if they’re not billing the insurance directly.

The whole process usually takes two to three weeks from the day they receive your claim. In some cases, it’s faster — especially for preventive care. In others, especially if documentation is missing or the procedure requires extra review (like root canals, oral surgery, or implants), it can take longer. If they deny a claim, you’ll get a letter explaining why — usually tied to a waiting period, a policy exclusion, or a misunderstanding of what was actually done.

One thing to be aware of: what your dentist charges and what Physicians Mutual pays may be wildly different. That’s not a glitch — it’s how fixed-benefit policies work. But it does mean you need to get comfortable asking your dentist for procedure codes and prices in advance, especially for expensive work. That way, you can cross-reference with the benefit schedule and know ahead of time what the insurance will actually send you back.

And yes — sometimes, that number will feel small. People are often surprised when they get a $400 check toward a $1,500 crown, even though the brochure mentioned coverage for “major services.” That’s why reading the actual schedule of benefits, not just the high-level summary, is essential. If you don’t have a copy, ask for it — it’s part of the application packet and the only real way to know how much help you’re getting.

Bottom line: this isn’t a swipe-your-card, walk-away type of insurance. It requires a little planning and follow-through. If you’re the kind of person who likes clear expectations and doesn’t mind handling your own paperwork (or at least confirming that your dentist will), the process is manageable. If you expect it to work like employer medical insurance, where everything’s invisible and automatic, the friction might catch you off guard.

Part Five: Is It Worth It? Real-Life Use Cases

The hardest part about evaluating dental insurance isn’t reading the fine print — it’s figuring out whether any of it applies to you. On paper, Physicians Mutual offers a reasonable blend of coverage, flexibility, and predictability. But in real life, its value depends almost entirely on what your teeth need, how often you go to the dentist, and what you expect out of insurance.

Let’s start with one common scenario: a retired adult in their late 60s. They’ve lost their employer dental plan, and now they’re looking for something to cover cleanings, occasional fillings, and — realistically — dentures in a few years. For someone in that position, a Physicians Mutual plan can actually make a lot of sense. Cleanings and exams are covered early and generously. Dentures are considered a major service, and while the reimbursement isn’t full, it’s predictable. If they stay on the plan for a couple of years, they’ll get a decent payout toward those costs — more than enough to offset the premiums if they’ve had moderate work done along the way.

Now take someone else: a 35-year-old with good teeth, no fillings, and a twice-a-year dental habit. For them, the picture’s very different. They might pay $40 a month for a policy that covers two cleanings per year — which their dentist charges $100 each for. That’s $240 in premiums for $200 worth of cleanings. They’re already slightly behind — and if they don’t need any restorative work, they may never catch up. That doesn’t mean the policy is worthless, but it does mean that for people with low-risk, low-cost dental needs, this kind of plan might not save money. It might just smooth the bills.

Then there’s the middle ground: someone who knows they need dental work but can’t afford to pay for it all at once. Maybe they need a crown, or they’re dealing with recurring cavities. In that case, the insurance won’t cover everything — but it can take some of the pressure off. Even if the reimbursement is only 25–40% of the total cost, that’s still hundreds of dollars back in your pocket, plus preventive coverage going forward. For people in this category, the value of the plan is as much psychological as it is financial: it gives them a framework, a sense that they’re not going into procedures alone.

And finally, there’s the case of someone shopping based on fear — the what-if buyer. “What if I break a tooth? What if I need a root canal?” This person may not use the plan much in year one, but they like having a soft barrier between them and surprise expenses. For them, the plan works more like a subscription to peace of mind. It doesn’t save them money in the short term, but it protects against the feeling of being caught completely off guard later.

So is it worth it? That depends on what you’re buying it for. If you expect it to act like major medical insurance, you’ll probably be frustrated. If you’re hoping it will fully cover a $2,000 dental bill, you’ll be disappointed. But if you’re looking for predictability, a little financial padding, and steady support for preventive care — and you’re okay reading the schedule of benefits — then yes, it can be a worthwhile tool.

It’s not a magic shield. It’s a plan. And like most plans, it works best when it matches how you actually live.

Part Six: Common Complaints and Misunderstandings

If you spend enough time reading customer reviews of Physicians Mutual — or talking to people who’ve had the plan for a year or two — you’ll start to see a pattern. Most of the frustration doesn’t come from what the insurance does. It comes from what people assume it does before they’ve actually used it.

The first misunderstanding usually revolves around that big marketing phrase: “no annual maximums.” It’s technically true. Unlike many dental plans that stop paying once you hit a $1,500 or $2,000 cap in a year, Physicians Mutual doesn’t have a total-dollar ceiling. You can submit as many claims as you want. But — and this is the part that matters — you’re still limited by the fixed benefit amounts for each procedure. So yes, you can get three crowns in a year, and the company won’t say “you’ve maxed out.” But they’ll still only pay $300–500 per crown (depending on the plan and year), and you’re on the hook for the rest. That “no maximums” pitch sounds generous until you realize it doesn’t mean unlimited payouts — just unlimited submissions.

Then there’s the issue of year-by-year benefit increases. People often assume that once they’re covered, they’re covered — and when they see that their first crown only got a $250 reimbursement, they’re frustrated. But the policy doesn’t pay the full amount right away. Instead, the coverage ratchets up over time. That’s how the company spreads out risk — and how they encourage people to stick around long-term. If you cancel in year one, the value is usually low. If you stay into year three, the benefit amounts are noticeably better. It rewards patience. But if you bought the policy thinking you’d be fully covered in six months, that curve can feel like a bait-and-switch.

Another common complaint is around pre-existing conditions and waiting periods. Even though the company doesn’t deny coverage for having “bad teeth” — and they don’t require an exam to enroll — not everything is covered right away. Major procedures usually come with a waiting period, often around 12 months. Some types of dental work tied to pre-existing issues might be only partially covered — or reimbursed at a lower rate — depending on when the problem started. If you buy the plan because you just found out you need a root canal, you’re probably going to be disappointed in the timing.

People also run into confusion over dentist participation. Because there’s no network, many assume their dentist “takes the insurance.” But that’s not quite right. Physicians Mutual doesn’t operate like PPO or HMO plans. Your dentist doesn’t have to accept it or bill it. In many cases, you pay the dentist directly and submit the claim yourself. If your dentist is helpful, great — they might do it for you. But if they’re unfamiliar with the plan or don’t deal with out-of-network paperwork, you’ll be the one faxing receipts and waiting for checks.

And finally, there’s the very real issue of underestimating costs. People sign up thinking the insurance will cover “most” of the bill, only to realize it’s covering a set number of dollars, not a percentage. If you don’t ask for the actual benefit schedule — or if you don’t compare it to your dentist’s fees before getting work done — that gap can feel shocking. A $400 reimbursement on a $1,500 procedure doesn’t feel like insurance if you weren’t expecting it.

None of this makes the plan bad. But it does make it misunderstood. Most of the complaints could be avoided if people went into the plan knowing exactly how it works: that it’s steady, limited, and up-front about what it pays — if you know where to look.

Part Seven: Alternatives and How It Compares

The truth is, Physicians Mutual doesn’t exist in a vacuum. It’s one of many options out there for people trying to manage dental expenses without employer coverage. And the challenge isn’t just choosing the “best” plan — it’s figuring out which type of plan fits your situation, your budget, and your tolerance for unpredictability.

Let’s start with traditional PPO dental insurance, like what you might get through Delta Dental, Guardian, or UnitedHealthcare. These plans are often tied to provider networks. You pick a dentist from the list (or pay more to see someone out of network), and coverage is typically structured around percentages — 100% for preventive, 80% for basic, and 50% for major work, after a deductible. That sounds great, but it also comes with annual maximums — usually around $1,000 to $2,000 — and those caps can run out quickly if you need multiple procedures in the same year.

Compared to that, Physicians Mutual can seem more flexible. No networks. No annual cap. More predictable pricing. But it comes at the cost of lower reimbursements, especially early on, and no negotiated discounts. If your dentist isn’t in a PPO plan but you don’t want to switch providers, Physicians Mutual might be easier to manage — but less generous per dollar spent.

Then there’s the Medicare angle. Many seniors assume Medicare covers dental. It doesn’t — at least not standard cleanings, fillings, crowns, or dentures. That’s why some people turn to Medicare Advantage plans (Part C), which often bundle in limited dental coverage. But those dental benefits usually come with strict networks, low yearly caps, and limited options for major procedures. Compared to that, a standalone plan like Physicians Mutual can offer better long-term support, as long as you don’t mind the waiting period and handling claims yourself.

What about dental discount plans? These aren’t insurance at all — they’re membership programs where you pay a yearly fee (usually $100–150) and get access to negotiated rates from participating dentists. There’s no reimbursement, just upfront discounts. A crown might cost $700 instead of $1,200, and you pay the dentist directly. These plans are great for people who don’t like paperwork and want clarity at the point of care. But they only work if your dentist participates — and they offer no cost sharing at all. You’re still paying, just a little less.

So where does that leave Physicians Mutual?

It sits somewhere in the middle: more flexible than PPOs, more structured than discount plans, and more accessible than most Medicare add-ons. It’s not ideal for someone who wants 80–90% of their dental costs covered. It’s not great if you need major work right away. But it holds up well for people who:

- want freedom to see any dentist,

- are okay with submitting claims themselves,

- and like the idea of gradual but permanent benefits instead of strict annual caps.

It’s also worth noting that Physicians Mutual doesn’t cancel you for high usage. Some discount plans quietly stop renewing people who get too much work done. With Physicians Mutual, once you’re in and paying, the plan matures — and in some cases, the longer you’re enrolled, the better the value becomes.

Still, the trade-offs are real. The coverage is slow to ramp up. The reimbursement amounts are lower than people expect. And unless you know your dentist’s pricing — or are comfortable calling and asking for procedure codes before treatment — you could end up with more surprises than you bargained for.

That’s why comparison shopping isn’t just about monthly premiums. It’s about how you use dental care, where you get it, and how much complexity you’re willing to manage in exchange for savings or flexibility.

Part Eight: Frequently Asked Questions

Is there a waiting period for major dental services?

Yes, and this is one of the most important things to understand before signing up. Physicians Mutual typically imposes a waiting period — often around 12 months — before it will reimburse for major procedures like crowns, root canals, bridges, or dentures. This waiting period helps the company prevent what’s called adverse selection — where people enroll, get expensive treatment right away, and then cancel. It’s standard for most standalone dental policies. The key is to plan ahead. If you think you’ll need major work soon, this isn’t a plan to rely on for immediate help.

Can you use it immediately after signing up?

Sort of. Preventive services like cleanings and exams are usually covered right away — sometimes with full reimbursement depending on your plan level and the provider’s rates. But anything beyond preventive care — especially fillings, extractions, or crowns — will be limited during the first year. Some minor services may be reimbursed at a low rate during year one, then increase over time. So yes, the plan is active immediately. But that doesn’t mean everything is available immediately.

Do you have to see a “network dentist”?

No. Physicians Mutual doesn’t use a provider network. That means you’re free to see any licensed dentist, anywhere in the U.S. On the surface, this sounds great — and for many people, it is. You can stick with your longtime dentist without worrying whether they’re “in network.” But there’s a tradeoff: because there’s no network contract, your dentist can charge whatever they normally charge — and you’ll have to cover any gap between that and what the plan reimburses. Some dentists will bill the plan directly, but many will ask you to pay upfront and file for reimbursement yourself.

How much does it actually pay for a crown or root canal?

That depends on your plan tier and how long you’ve been enrolled. In the early years, reimbursement might be in the $200–400 range for a crown or root canal. After three years, it might go up to $500 or slightly more — but it’s still likely to fall well short of the total cost. Most dentists charge $1,000 to $1,600 for these procedures. So while the plan helps, it doesn’t cover the full amount. This is where a lot of disappointment comes from — people expect “coverage,” but what they’re really getting is a flat reimbursement, not a percentage of the total.

Can this be used with a Medicare Advantage plan?

Yes, it can — but it’s not bundled in. Medicare Advantage plans sometimes offer limited dental coverage as part of their package, but the benefits are often minimal and tied to a narrow network. Physicians Mutual operates independently. You can carry both at the same time. If your Medicare Advantage plan gives you $1,000 a year toward dental, and you also have a Physicians Mutual plan, you can use both — as long as the dentist is willing to process both claims or help you coordinate reimbursement. Just remember: you may still end up managing much of the paperwork yourself.

Is it worth it for someone with good teeth?

That depends on what you value. If your dental care consists of cleanings and the occasional X-ray, and you have no history of cavities or restorations, you might not come out ahead financially. You could end up paying more in premiums than you’d spend out-of-pocket for basic care. But for some people, the value isn’t just in savings — it’s in stability. They like having something in place just in case. They like knowing they’ll get partial reimbursement if something goes wrong. And they want a plan that’s there for the long haul, even if it means paying a little more in quiet years to have coverage in active ones.

Closing Thoughts

Dental insurance is rarely about covering everything. It’s about managing risk — spreading the cost of care across time, giving you a buffer when the bills start to climb, and helping you plan without guessing. Physicians Mutual doesn’t promise to pay the full cost of your dental work, and it’s not trying to compete with employer-sponsored PPOs. What it offers instead is steady, flat-rate support, year after year, for people who want flexibility, predictability, and some degree of protection — especially as they age.

That said, it’s not a perfect fit for everyone. If you need major work right away, the waiting periods will probably frustrate you. If your dentist charges significantly more than the plan reimburses, you’ll be making up the difference out of pocket. And if you expect it to feel like medical insurance — with full coverage and automatic billing — you’re likely to be disappointed.

But if you understand how the plan actually works, and you’re okay with the trade-offs, it can be a genuinely useful tool. It won’t eliminate dental bills. But it can soften the blow, particularly when you’ve had the plan for a few years and the reimbursement levels improve.

The key is clarity. Ask questions. Read the benefit schedule. Look at your dentist’s pricing. And decide based not on the headline promises, but on how the plan fits your own needs — not just today, but two or three years from now. Because when it comes to dental care, the best policy isn’t just one that pays out — it’s one that you’ll actually use without regret.